-

8613931787312

8613931787312 -

Botou Industrial Zone on the east side of National Highway 104, Botou City, Hebei Province

Botou Industrial Zone on the east side of National Highway 104, Botou City, Hebei Province

- Afrikaans

- Albanian

- Amharic

- Arabic

- Armenian

- Azerbaijani

- Basque

- Belarusian

- Bengali

- Bosnian

- Bulgarian

- Catalan

- Cebuano

- Corsican

- Croatian

- Czech

- Danish

- Dutch

- English

- Esperanto

- Estonian

- Finnish

- French

- Frisian

- Galician

- Georgian

- German

- Greek

- Gujarati

- haitian_creole

- hausa

- hawaiian

- Hebrew

- Hindi

- Miao

- Hungarian

- Icelandic

- igbo

- Indonesian

- irish

- Italian

- Japanese

- Javanese

- Kannada

- kazakh

- Khmer

- Rwandese

- Korean

- Kurdish

- Kyrgyz

- Lao

- Latin

- Latvian

- Lithuanian

- Luxembourgish

- Macedonian

- Malgashi

- Malay

- Malayalam

- Maltese

- Maori

- Marathi

- Mongolian

- Myanmar

- Nepali

- Norwegian

- Norwegian

- Occitan

- Pashto

- Persian

- Polish

- Portuguese

- Punjabi

- Romanian

- Russian

- Samoan

- scottish-gaelic

- Serbian

- Sesotho

- Shona

- Sindhi

- Sinhala

- Slovak

- Slovenian

- Somali

- Spanish

- Sundanese

- Swahili

- Swedish

- Tagalog

- Tajik

- Tamil

- Tatar

- Telugu

- Thai

- Turkish

- Turkmen

- Ukrainian

- Urdu

- Uighur

- Uzbek

- Vietnamese

- Welsh

- Bantu

- Yiddish

- Yoruba

- Zulu

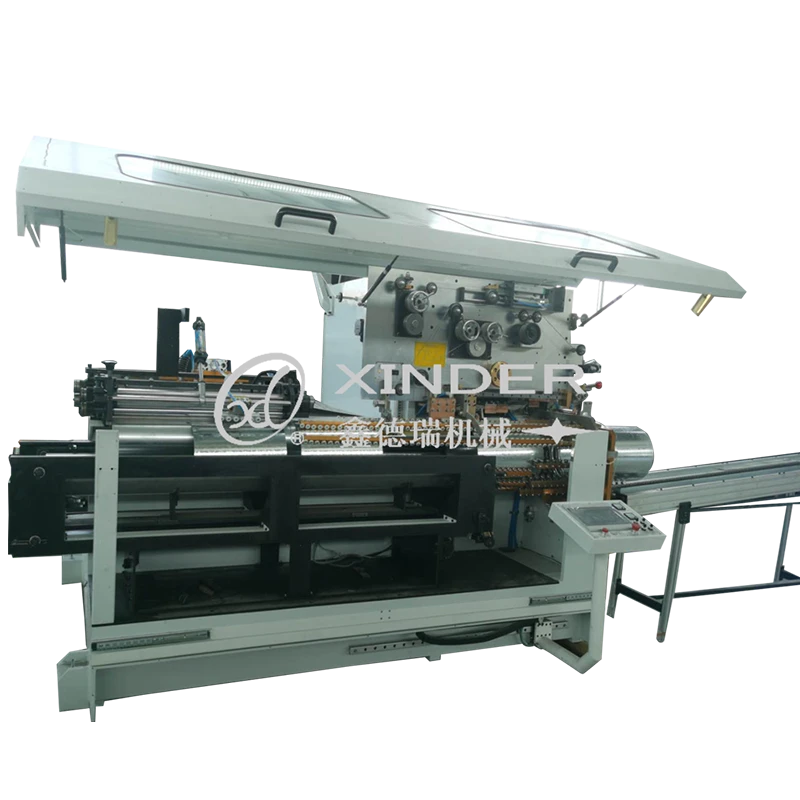

High-Quality Bending Machine China Manufacturer Reliable Spiral Welded Pipe Making Machine Supplier

- Introduction to Bending Machine China: Industry Landscape and Growth Trends

- Technical Advantages of Bending Machines in the Chinese Market

- Comparative Analysis of Leading Bending Machine Manufacturers

- Customization Solutions for Diverse Industrial Needs

- Insight into Spiral Welded Pipe Making Machines in China

- Application Cases: Success Stories from Global Enterprises

- Future Prospects of Bending Machine China in International Manufacturing

(bending machine china)

Introduction to Bending Machine China: Industry Landscape and Growth Trends

The Chinese bending machine industry has experienced exponential growth over the last two decades, emerging as a global leader in manufacturing and export. According to industry data, in 2023, China accounted for more than 36% of the world’s supply of various industrial bending machines. The market’s momentum is driven by continued investments in automation, quality standards, and export capability. Bending machine China is not just about volume; it is also about precision and technical upgrading, fueled by surging demand from automotive, construction, shipbuilding, and energy sectors. The industry, now estimated at over USD 2.7 billion, positions China at the forefront of innovation, efficiency, and cost-effectiveness. The following sections explore the technical superiority, competitive landscape, and real-world applications of these versatile machines.

Technical Advantages of Bending Machines in the Chinese Market

Chinese manufacturers have dramatically narrowed the technology gap with Western competitors by investing in R&D and adopting advanced production methodologies. One of the key advantages includes the integration of precision CNC controls, significantly reducing tolerances to ±0.2mm in many models, a figure within 5% of top-tier European machines. Automation has led to increased throughput from 8 to 14 bends per minute in modern lines, enhancing productivity. Furthermore, innovations in servo-hydraulic systems have cut power consumption by up to 28%, addressing energy efficiency concerns and lowering operational costs. Enhanced durability, modular machine frames, and digital maintenance features, like predictive analytics, are now standard in premium units. Such advances are critical for industries such as automotive chassis manufacturing, where consistency, repeatability, and cost are paramount.

Comparative Analysis of Leading Bending Machine Manufacturers

To evaluate the market, a comparison of leading manufacturers—both domestic and international—is essential. The table below summarizes key performance and pricing data for top brands, gathered from verified industrial procurement reports:

| Manufacturer | Origin | Max Bending Capacity (mm) | CNC Precision (mm) | Cycle Speed (bends/min) | Power Consumption (kWh) | Starting Price (USD) | Estimated Delivery Time |

|---|---|---|---|---|---|---|---|

| YSD (Yangli Group) | China | 20 | ±0.2 | 13 | 13.2 | $42,000 | 4 weeks |

| Mazak | Japan | 16 | ±0.18 | 11 | 14.5 | $68,000 | 7 weeks |

| Amada | Japan | 22 | ±0.15 | 12 | 16.2 | $85,000 | 6 weeks |

| Prima Power | Italy | 18 | ±0.2 | 10 | 15.5 | $74,000 | 9 weeks |

| Sunsing | China | 21 | ±0.22 | 10 | 13.9 | $47,000 | 3 weeks |

This comparison illustrates that Chinese bending machines offer a compelling mix of high productivity, close tolerances, and short delivery times, often at a fraction of the investment required for similar Western machines. Local after-sales support, software upgrades, and ability to handle higher workloads make them especially attractive for cost-conscious global buyers.

Customization Solutions for Diverse Industrial Needs

Modern industrial production rarely fits a “one size fits all” model, especially when handling advanced sheet metals, tubular structures, or complex geometries. Leading suppliers of bending machine in China provide extensive customization options, such as programmable multi-radius tools, 3D simulation software integration, and hybrid actuators for mixed-material capacity. Modular design concepts allow quick tool swaps—in under 10 minutes—and adaptive bending force adjustment from 5kN to 320kN. For industries such as aerospace and shipbuilding, bespoke safety shielding, remote monitoring modules, and temperature-compensated hydraulics ensure process reliability and compliance with international standards. Leading factories even offer ‘on-site engineering support’ and digital twin modeling during pre-production, which reduces time-to-market by an estimated 17%. These flexible solutions affirm the capability of china’s manufacturers to meet unique, evolving global demands.

Insight into Spiral Welded Pipe Making Machines in China

The market for spiral welded pipe making machines in China is expanding rapidly due to growth in energy, water, and infrastructure projects. Robust construction enables the bending and forming of pipes ranging in diameters from 219mm to 2540mm with wall thickness up to 25.4mm. China spiral welded pipe making machine output achieved roughly 42% of the world’s total newly installed capacity in 2022, exporting to over 60 countries. Standout features include automated welding heads with adaptive current control, inline ultrasonic testing, and high-speed digital forming lines capable of 15 meters per minute. Longitudinal precision has improved by 35% in the last five years, considerably reducing scrap rates. These innovations translate into improved profitability for pipe mill operators and contribute to the resilience of vast infrastructure networks worldwide. Such performance and reliability position china as a primary source for large and mid-scale welded pipe projects.

Application Cases: Success Stories from Global Enterprises

The international adoption of Chinese bending machines is best exemplified by industry success stories. For instance, a leading German automotive supplier replaced its legacy fleet with CNC models from China, reducing component cycle times by 19% while achieving a break-even return on investment within eight months. In another case, a construction equipment manufacturer in Brazil leveraged custom China spiral welded pipe making machines to expand output, supporting the development of 440 kilometers of pipeline infrastructure within just 18 months. In Southeast Asia, a furniture exporter utilized modular bending machine china

solutions for rapid line changeover, increasing annual productivity by 27% and slashing defect rates to under 1.3%. These global deployments highlight the machines' adaptability, cost efficiency, and the growing trust in Chinese manufacturing and technical expertise.

Future Prospects of Bending Machine China in International Manufacturing

As direct investments and R&D allocations in the Chinese machinery sector continue to rise, the position of bending machine china within global manufacturing is set for further strengthening. The adoption of Industry 4.0 principles—IoT-enabled monitoring, predictive maintenance algorithms, and data-driven optimization—are becoming standard among top-tier vendors, supporting higher efficiency and traceability. Export volumes are expected to grow by 13% annually through 2027, reflecting the steady international demand for competitive, reliable, and technologically-advanced equipment. International certifications, such as CE and ASME, are widely obtained, ensuring global market compatibility. As customization capabilities increase and support networks expand, buyers worldwide are more likely to select bending machines in China not just for up-front cost savings, but for complete lifecycle value, robust support, and continuous technical evolution.

(bending machine china)

FAQS on bending machine china

Q: What types of bending machines are available in China?

A: China manufactures a variety of bending machines, including hydraulic, CNC, and manual types. Each is designed for different materials and applications. You can find a wide selection from Chinese manufacturers.Q: Why should I choose a bending machine made in China?

A: Bending machines from China offer a balance of quality and cost-effectiveness. They often include advanced technology and customization options. Many suppliers provide excellent after-sales support.Q: Are there reputable suppliers for spiral welded pipe making machines in China?

A: Yes, China is known for reputable suppliers of spiral welded pipe making machines. These companies serve both domestic and global markets. Always check for certifications and client reviews for assurance.Q: Can I get bending machines in China suitable for custom orders?

A: Many Chinese manufacturers accept custom orders for bending machines. They can tailor specifications according to your industry needs. Contact suppliers directly to discuss customization options.Q: How do I order a bending machine in China and handle shipping?

A: Ordering a bending machine from China typically involves contacting a supplier, agreeing on terms, and arranging payment. Most manufacturers assist with logistics and export documentation. Reliable partners help ensure smooth international shipping.-

Unlocking the Power of Light: Exploring Modern Laser Welding SolutionsNewsJul.15,2025

-

Streamlining Steel Drum Manufacturing: A Guide to Barrel Production EquipmentNewsJul.15,2025

-

Precision Welding for Pipes and Sheet Metal: Elbow and Seam Welding TechnologiesNewsJul.15,2025

-

Mastering the Art of Metal Packaging: A Guide to Can Welding MachinesNewsJul.15,2025

-

Mastering Metal Bending: A Deep Dive into Elbow Fabrication MachinesNewsJul.15,2025

-

Automated Welding Machines: Revolutionizing Precision and Productivity in MetalworkNewsJul.15,2025

-

The Rise of Laser Welding in Global Manufacturing: Spotlight on China’s Competitive EdgeNewsJun.05,2025

-

Pneumatic Handle Welding MachineSep . 13, 2024

Pneumatic Handle Welding MachineSep . 13, 2024 -

Fully Automatic Kaiping Production LineOct . 17, 2024

Fully Automatic Kaiping Production LineOct . 17, 2024 -

Fully Automatic Metal Bucket Lifting HeadphonesSep . 14, 2024

Fully Automatic Metal Bucket Lifting HeadphonesSep . 14, 2024